Loyalife

AI-powered, end-to-end loyalty management infrastructure to turn engagement into revenue growth.

Role

Senior Product Designer

Skills

Research, Strategy, UX and UI Design, Prototyping and Product Thinking

Industry

Fintech, Banking and Enterprise Loyalty

About the Product

Loyalife is an AI powered, end to end loyalty management infrastructure for enterprises. It helps banks and large organizations convert customer engagement into measurable revenue impact through rewards, tiers, partner incentives and targeted campaigns.

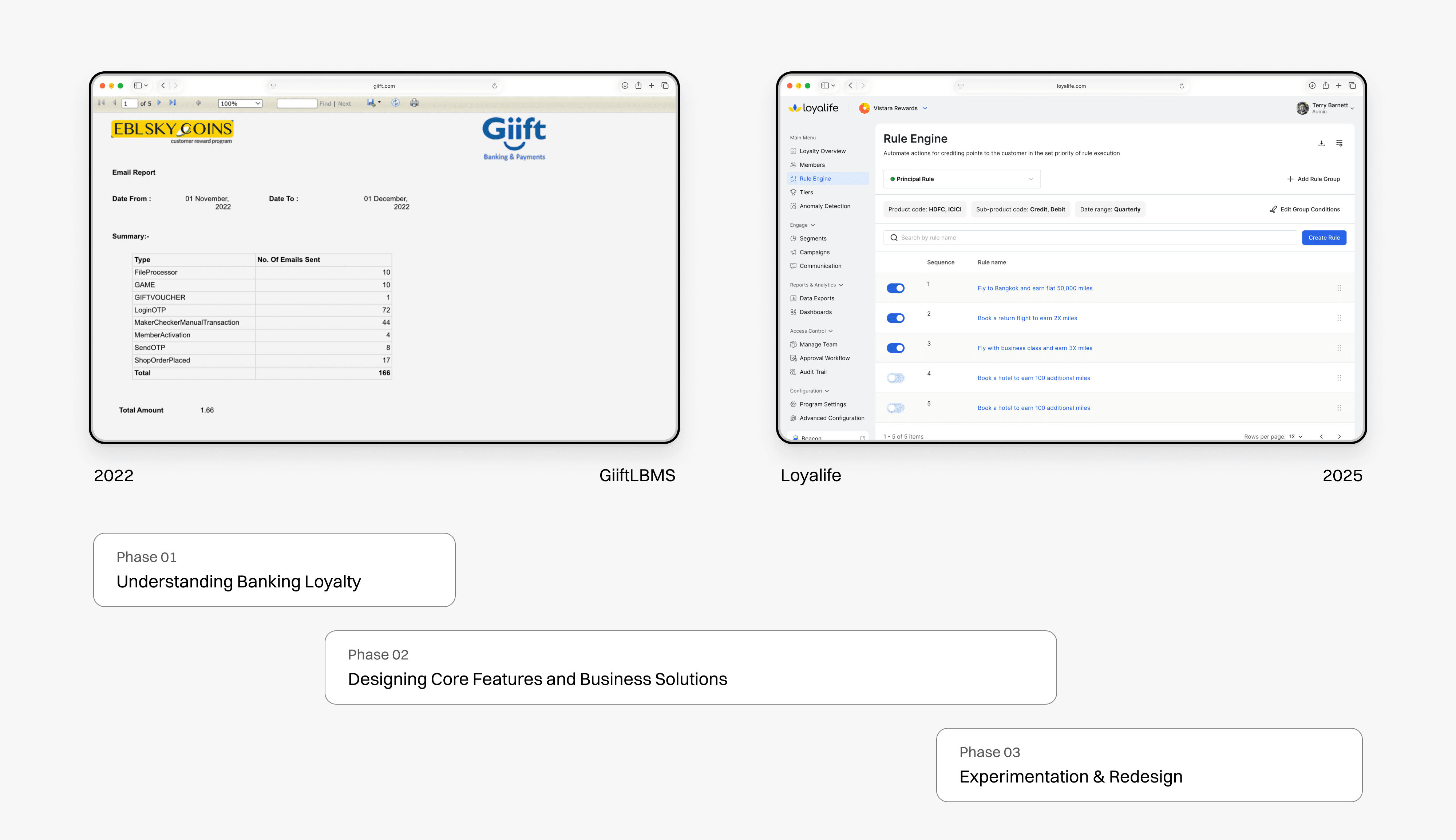

Product Journey

My time working on Loyalife can be divided into three phases.

Phase 1: Understanding Banking Loyalty

Phase 2: Designing Core Features and Business Solutions

Phase 3: Experimentation & Redesign

Phase 1: Understanding Banking Loyalty

The first challenge was to understand the meaning of loyalty from the perspective of banks. What does loyalty drive? Higher card spends? Better retention? More transactions? And what types of rewards or incentives truly motivate banking customers?

During this phase, I conducted user research, and competitive analysis to uncover pain points in existing loyalty systems. I explored multiple types of loyalty models including tiered systems, partner incentives, referral programs and point based mechanics. I also evaluated ways to extend loyalty beyond traditional banking use cases by including partners, merchants and influencers.

The conclusion was clear: loyalty in banking is not a one size fits all problem. It must be compliant, transparent and controlled while still delivering flexibility and meaningful value to customers.

Phase 2: Designing Core Features and Business Solutions

This phase involved translating research into tangible product features that solve business and user problems.

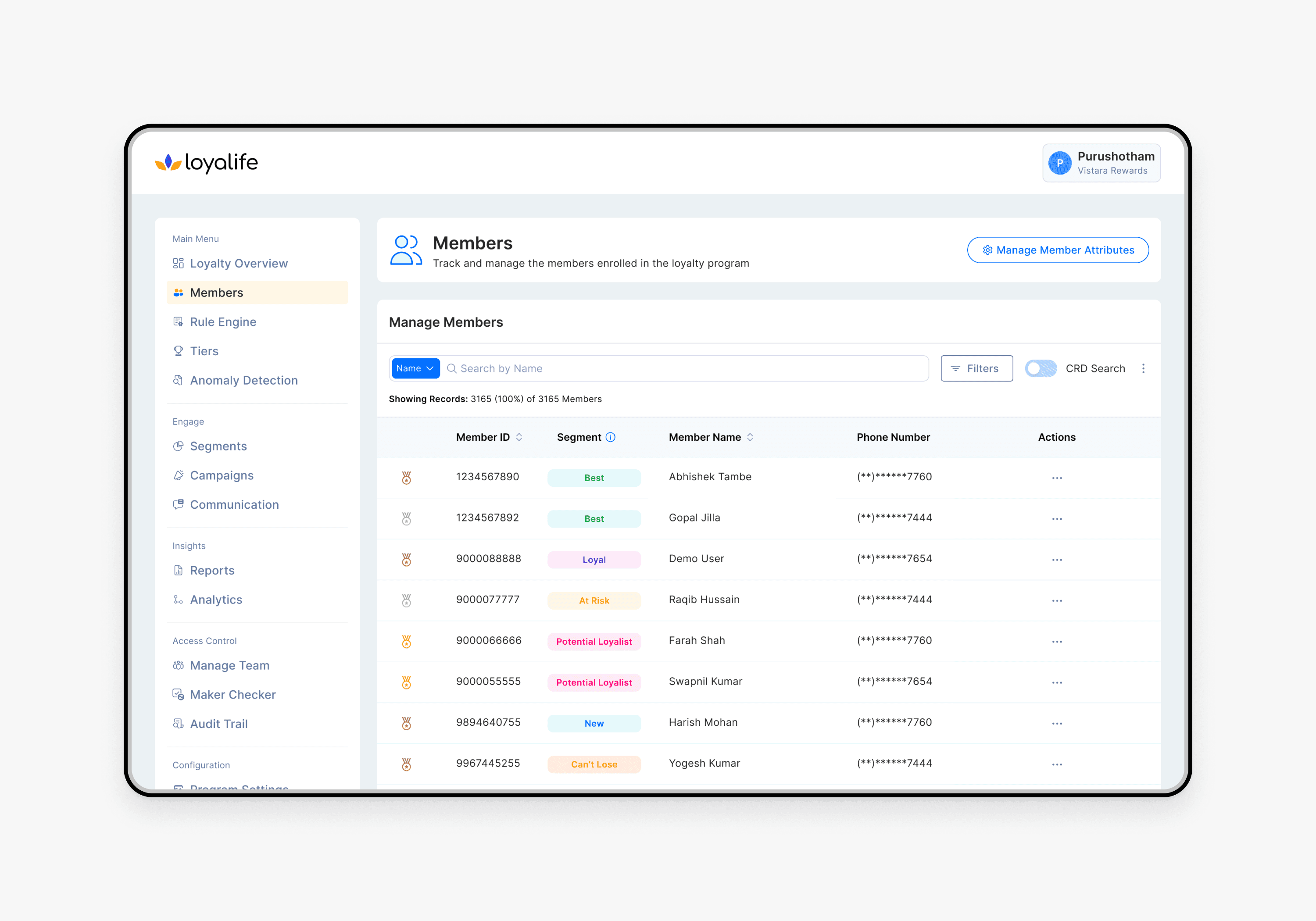

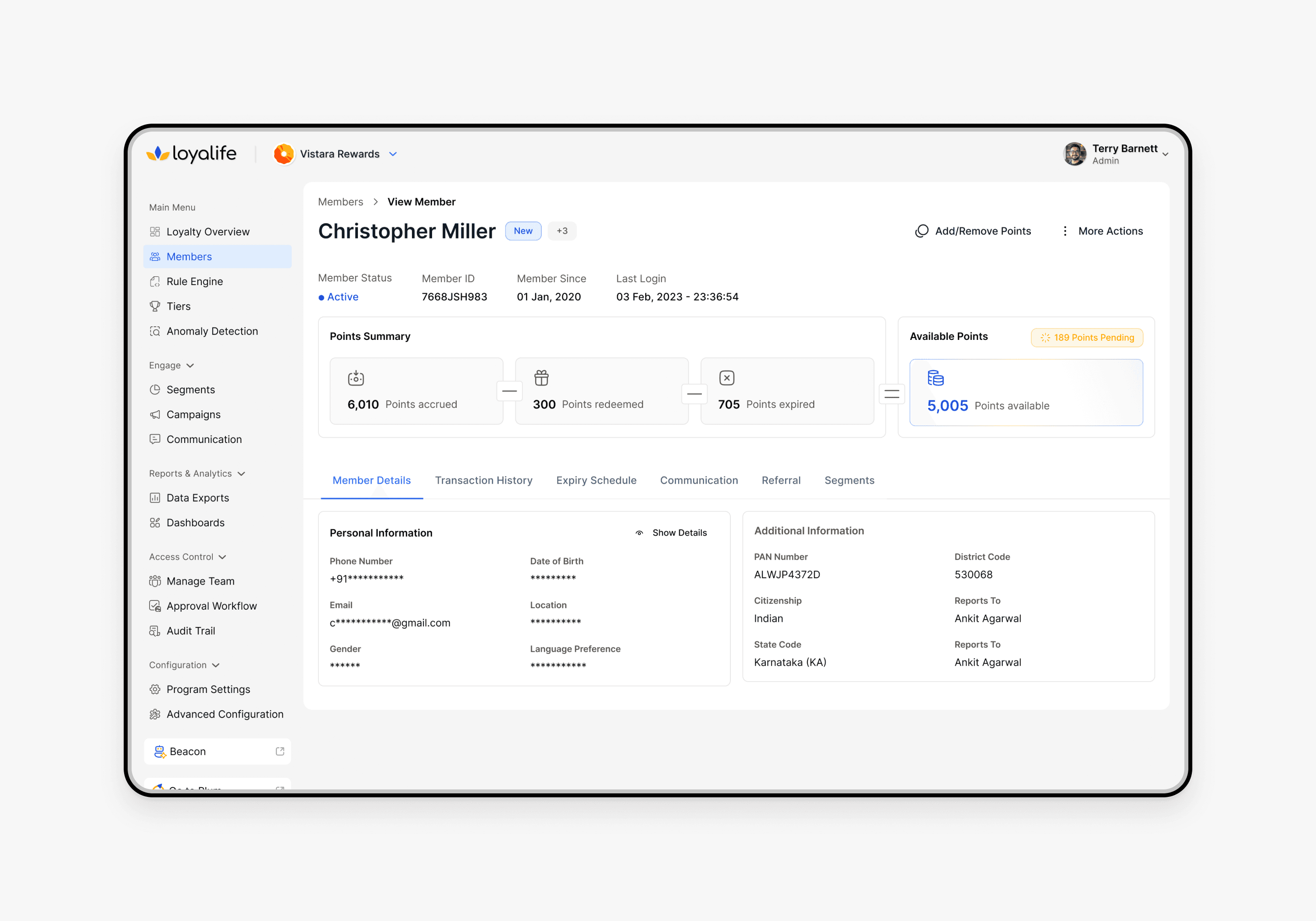

Members

A centralized system to manage customer information. This includes member attributes, member profiles, transaction history and behavioral data. It helps banks get a unified view of every member, which enables targeted engagement.

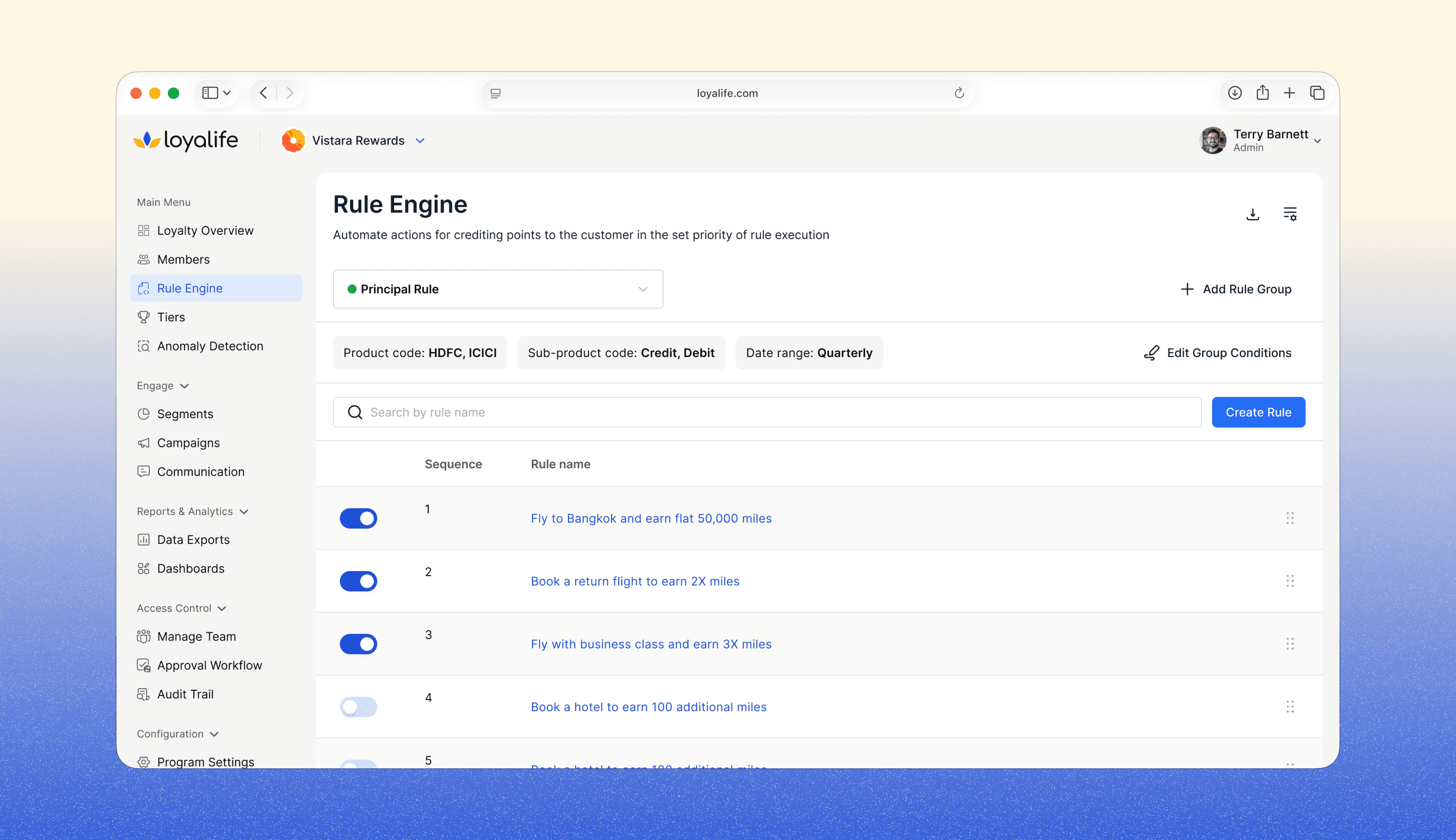

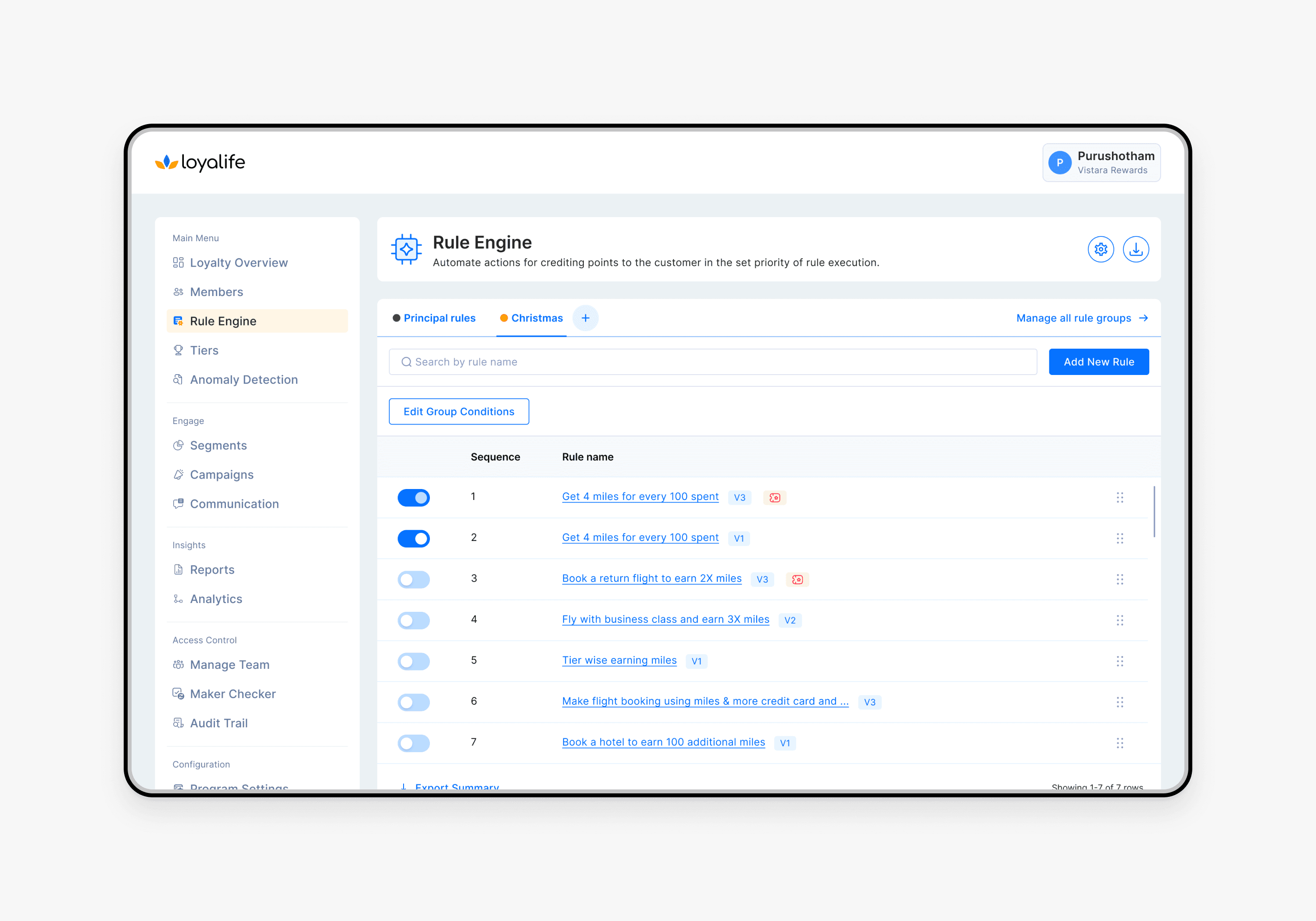

Rule Engine

The core of Loyalife. This engine controls how, when and what should be credited or debited for a user. It supports logic based on transactions, behavior, tier levels and segments. Banks can configure loyalty mechanics without heavy engineering dependency.

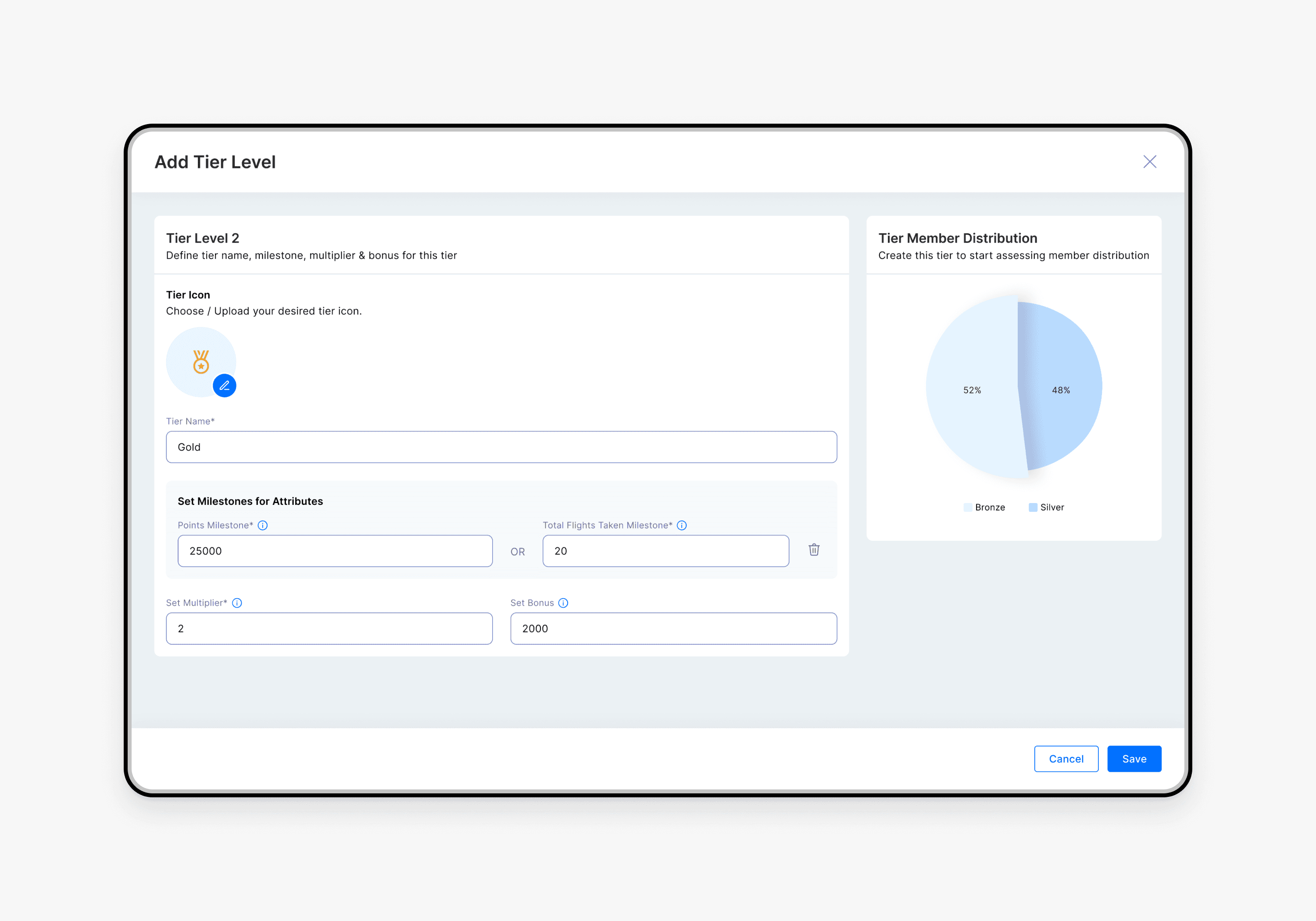

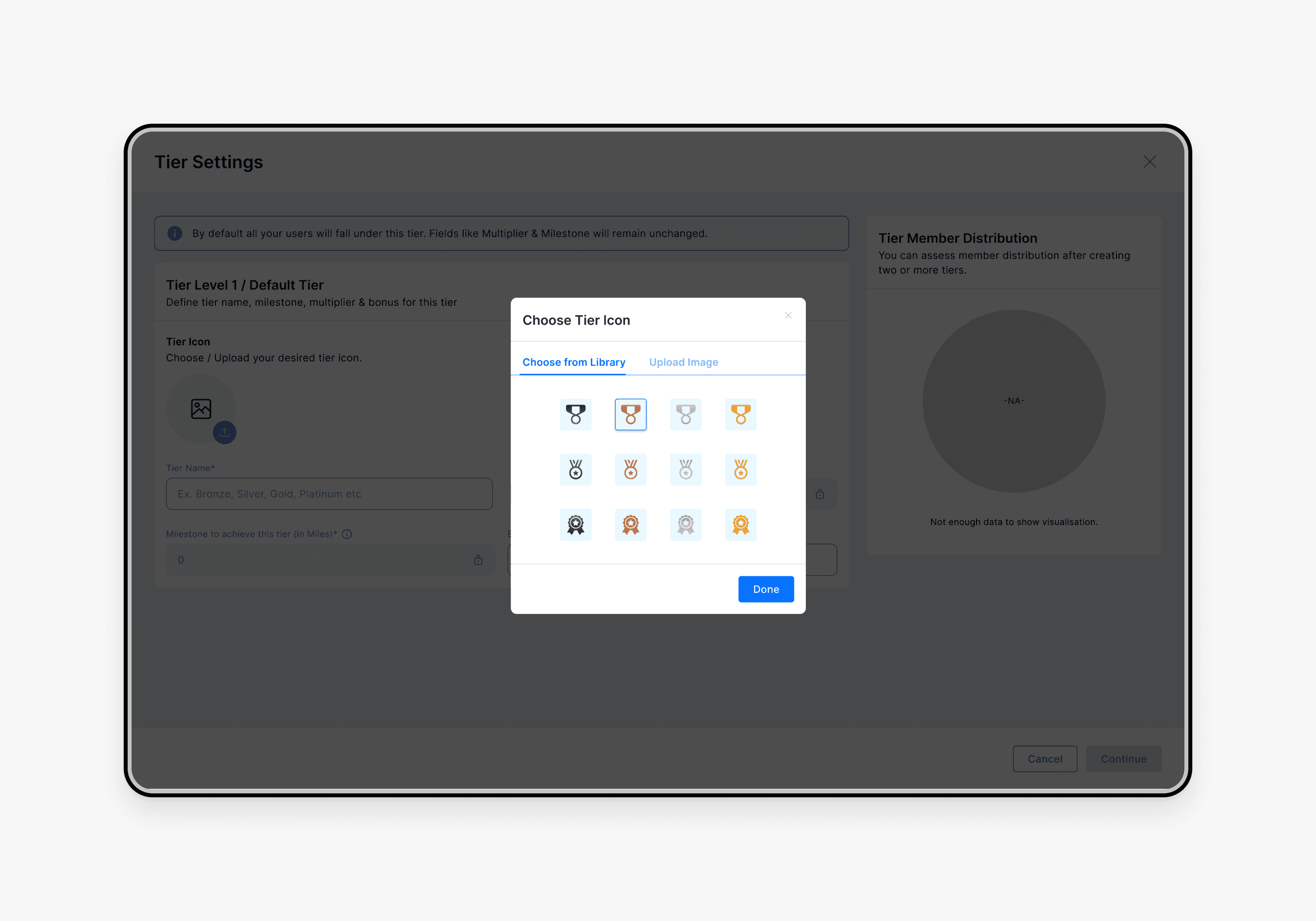

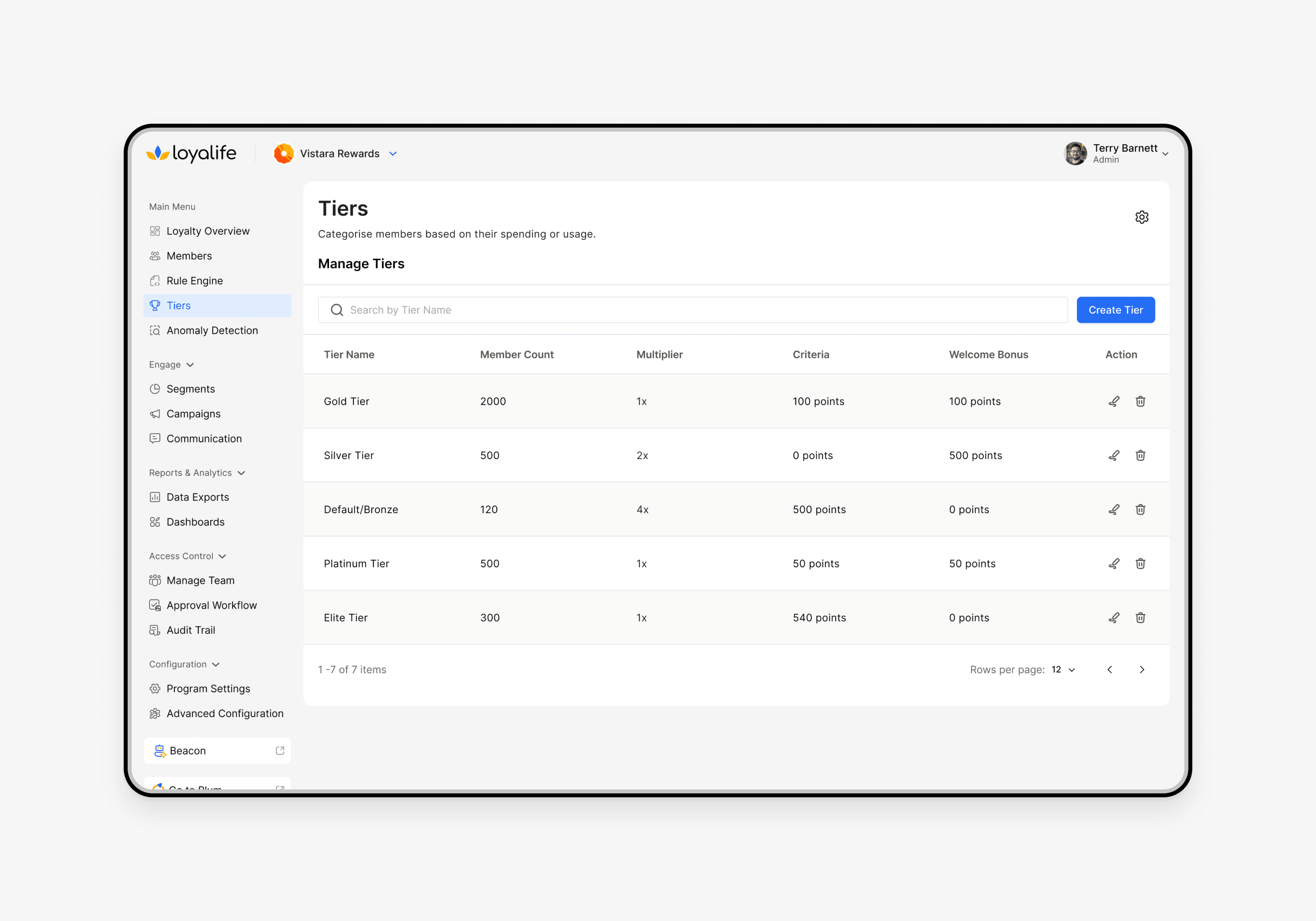

Tiers

A progression model that encourages members to move upward through levels. This creates motivation and exclusivity and is an important driver of engagement.

Engage

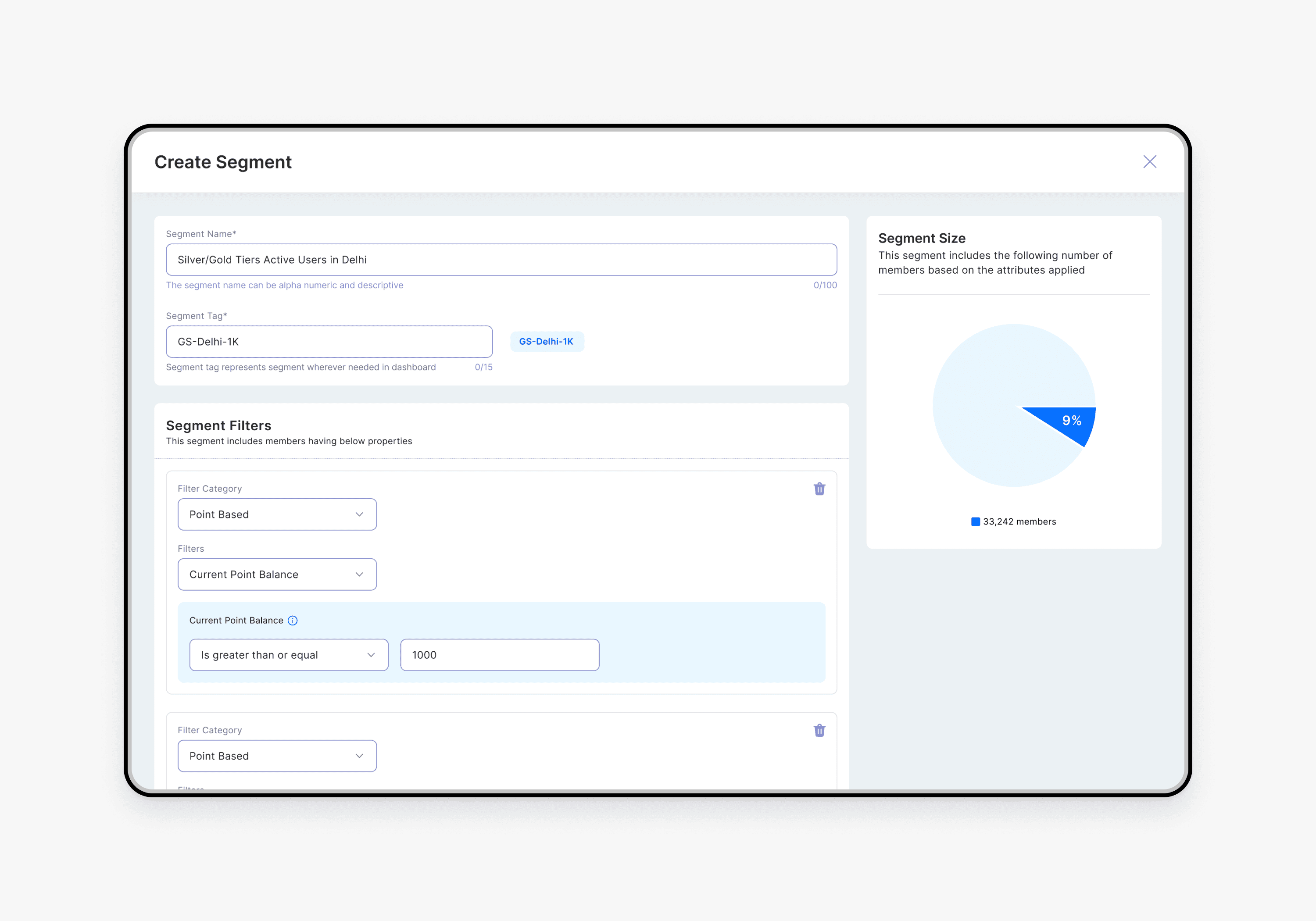

Segments: Create dynamic groups of members.

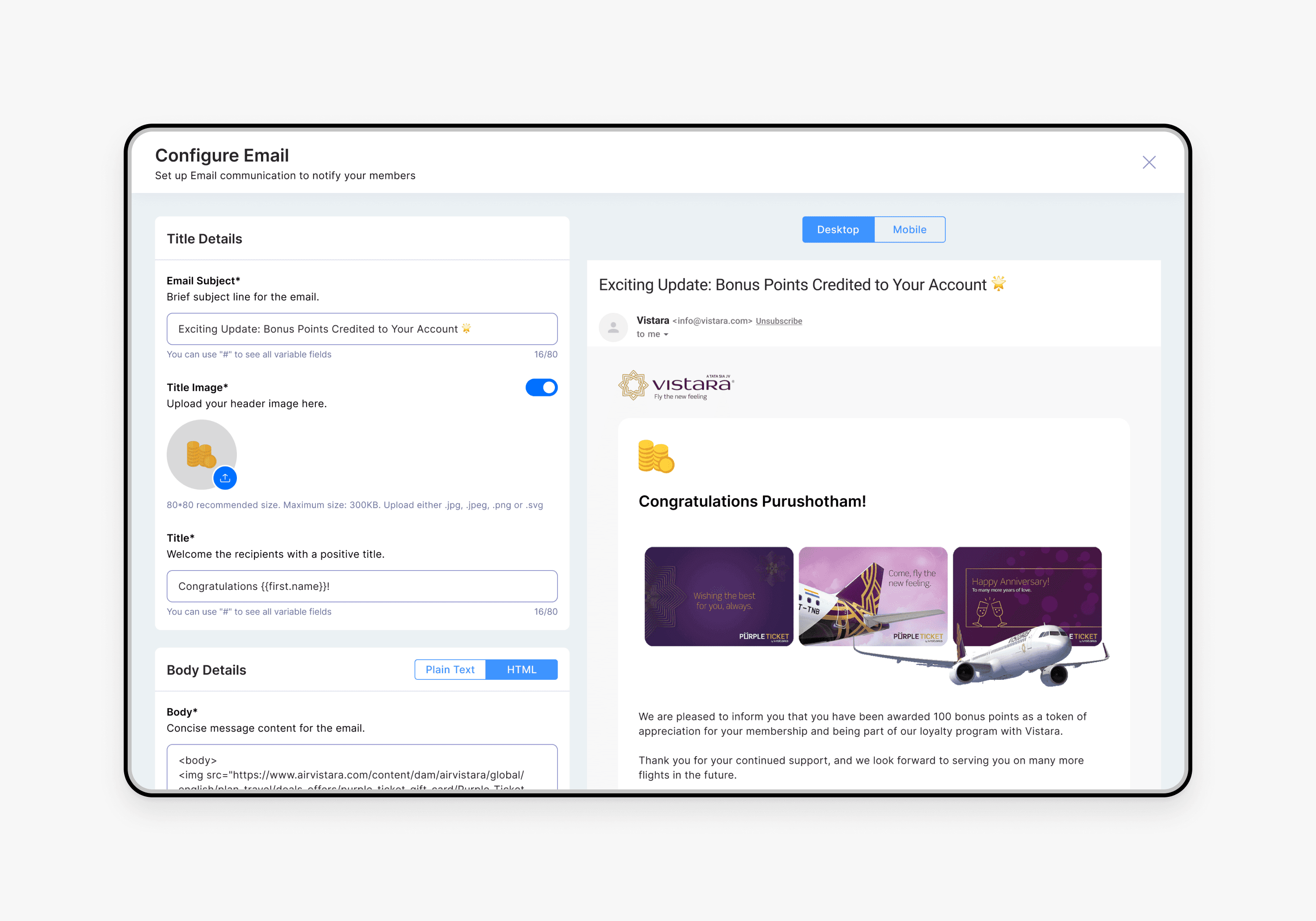

Communication Templates: Build email, SMS or WhatsApp templates.

Campaigns: Combine segments, templates and reward rules to run targeted loyalty campaigns. This empowers marketing and relationship teams to activate customers with personalized messages and rewards.

Maker Checker

A necessary requirement for banking software. Every critical action must pass through a reviewer and an approver. This ensures compliance, auditability and safety in regulated environments.

Phase 3: Experimentation & Redesign

With the core product stable, the focus shifted to improvement, scalability and experimentation.

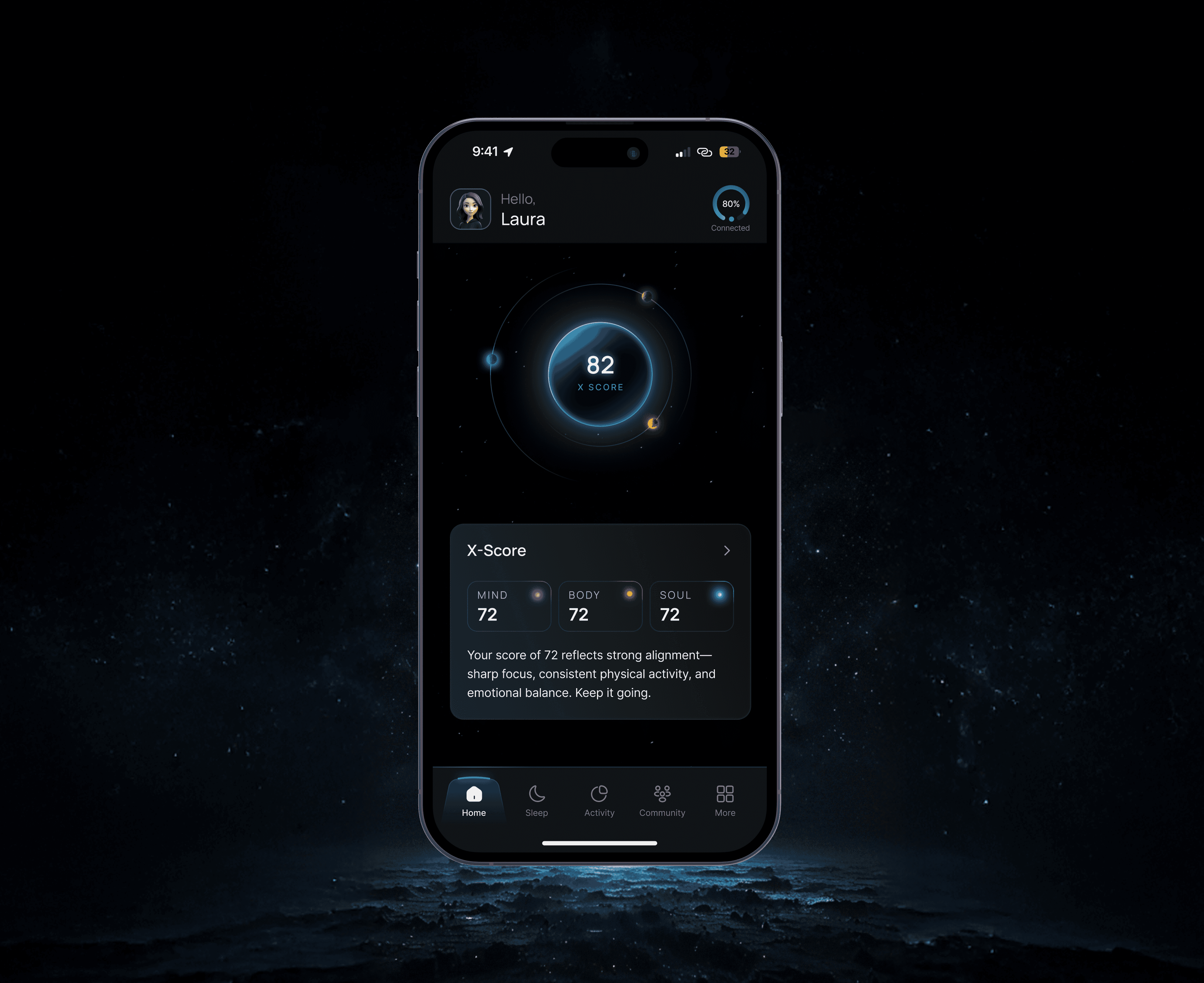

Beacon AI Chatbot

Beacon is an AI powered assistant built for Loyalife, enabling enterprises to ask, create and optimize their loyalty programs with AI driven guidance.

Ask

Ask delivers instant loyalty insights, making analytics accessible to every stakeholder.

Create

Create empowers teams to design and configure loyalty programs end to end through an intuitive, enterprise-ready builder.

Optimize

Optimize provides advanced AI driven recommendations to enhance program efficiency, performance and ROI.

Business Outcomes

3.6x increase in card spends.

133% annual increase in active users.

44% sales growth driven by new use cases.

30% increase in customer retention.

Loyalife has been one of the most meaningful projects of my career.

Across three years, I contributed to shaping a platform that helps banks and enterprises transform loyalty into sustained revenue growth. The work combined research, systems thinking and strategic decision making, resulting in a product that is both powerful and easy to use.